|

||

|

Thank you for subscribing to my E-newsletter. I am honored to serve the 36th Senatorial District and look forward to working with you toward building a stronger Pennsylvania. This E-newsletter serves to keep you updated on what is happening throughout Lancaster County and what I am doing as your State Senator in Harrisburg – I hope that you find it helpful! Should you have any questions, comments, or concerns, please DO NOT reply to this email; instead, please feel free to contact me here.

In this update:

Voter ID: Time for PA to Catch Up with Other States, Nations

A proposed constitutional amendment passed by the Senate earlier this month to require ID verification at polling places remains in the House of Representatives. Its approval is needed to let voters have a say through a ballot question in the spring primary election. Pennsylvania’s failure to enact this key component of election integrity has put it behind not only a vast majority of states and most developed countries, but behind many developing nations as well. Every excuse used to block this rational election reform has been shown to be false. Requiring proof of identification before voting does not suppress turnout, and acceptable IDs are not difficult to obtain. Nationally, the calls for voter ID come from Democrats and Republicans alike. Eighty percent of Americans favor voter ID as do 74% of Pennsylvanians. Now is the time to pass Senate Bill 1 and let the voters decide. Reducing the Tax Burden on Pennsylvanians

Inflation is hitting Pennsylvanians hard. While the problem was created at the national level, I understand that it doesn’t matter where it originated; people just need relief. When money is tight, the last thing government should do is take more out of the pockets of citizens. One of my priorities for 2023 is to reduce the tax burden so Pennsylvanians can keep what they earn. That priority will impact the proposals I support as I assess how legislation introduced in the Senate may ultimately help or hurt commonwealth residents. If you have ideas about how we can reduce the tax burden, I encourage you to click here to fill out a short online form. You’re always welcome to schedule an appointment here if you prefer to connect in person. Restoring Checks and Balances in Pennsylvania Government

In addition to letting citizens decide whether voters should be required to show ID, Senate Bill 1 includes a proposed constitutional amendment allowing the people’s representatives in the General Assembly to overturn any government regulation that conflicts with the will of the people. The need for this change was made clear by the Wolf administration’s unilateral decisions during the pandemic, closing businesses and schools with no input from the people. Despite the clear design of our government with three co-equal parts, the executive branch elevated itself above the legislative and judicial branches in an obvious violation of the checks and balances afforded by the Pennsylvania Constitution. No governor of any party should be permitted to wield such unchecked power again. If the House of Representatives follows the Senate’s lead and passes Senate Bill 1, voters will be empowered to restore this crucial balance of power. Phase-out of Job-Killing PA Tax Begins

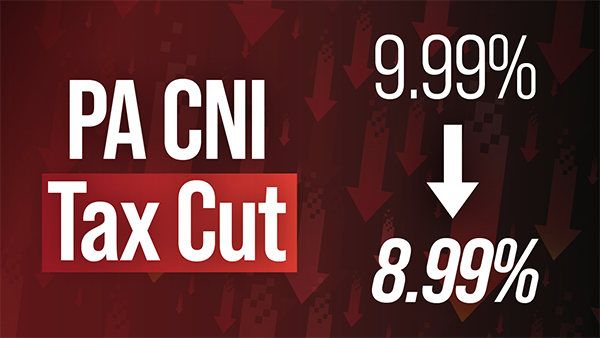

The phase-out of Pennsylvania’s sky-high Corporate Net Income tax got underway this month, part of our efforts to keep good jobs here and create new ones. My colleagues and I secured a cut in this job-killing tax as part of the 2022-23 state budget, based on a proposal I sponsored. Before this reduction to 8.99%, Pennsylvania’s CNI tax had been 9.99% for nearly three decades while other states had lower tax rates – some far lower – and many have been lower for almost as long. When gradually reduced to 4.99% in 2031, Pennsylvania’s CNI rate will have gone from one of the highest in the nation to one of the lowest, making the commonwealth far more competitive with other states. A 2009 report by an economist at the Federal Reserve Bank of Kansas City demonstrates that the burden of the corporate income tax is borne in large part by labor within the state in the form of lower wages. A 2016 paper published in the journal American Economic Review found employees shoulder about a third of the corporate tax burden. Reducing this tax will be the difference between jobs coming to our local communities and jobs leaving. This will be a great benefit to Pennsylvania families. Job Well Done to Local Eagle Scout

From left: Greg Hitz, Charles “Chas” Bibleheimer, and Pastor Albert Domines. Both gentlemen in the picture were instrumental in helping Chas in his scouting career. Congratulations to another young man who achieved the highest advancement rank available in the Boy Scouts of America: Charles “Chas” Bibleheimer. Chas is a member of Troop 1, which he served as patrol leader and assistant senior patrol leader. He is also a member of the Order of the Arrow. For his Eagle Scout community service project, Chas designed and built a meditation garden for the Cassel Farm Nature & Fellowship Area at the Christ Lutheran Church in Elizabethtown. Rebates for Property Taxes and Rent Available to Seniors, Pennsylvanians with Disabilities

Older adults and Pennsylvanians with disabilities can apply now for rebates on property taxes or rent paid in 2022. The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in the claim year and meet all other eligibility criteria. The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. You can find more eligibility and application information here. Eligible applicants can visit mypath.pa.gov to electronically submit their applications. Congrats to Warwick High School Marching Band

It was my pleasure to visit Warwick High School to congratulate and present a Senate Citation to members of the marching band. For the first time in 14 years, the Warwick Marching Band won gold at the 2022 Cavalcade of Bands in Hershey. Congratulations! Virtual Reading with Local Kindergarteners

I enjoyed reading the book “The Rainbow Fish” by Marcus Pfister to Mrs. Dajzak’s kindergarten students at PA Virtual Charter School. We had a terrific discussion about being kind to others, and I hope it helped them get excited about reading. It’s a great way to ignite a lifelong love of learning in young students. Discussing Ways to Get Involved with Local Government

What an honor it was to join a distinguished Leadership Lancaster Governance and Lancaster County panel discussion as part of their Core Class 2023’s Public Policy and Economic Development Session at Elizabethtown College. We talked about ways people can be more involved with local government matters, as well as the current and future economic issues of Lancaster County. I appreciated the opportunity to share my experiences creating public policy and collaborating with community organizations, businesses and government entities. Local Organizations Can Apply Now for Conservation Grants

Counties, municipalities and municipal agencies, pre-qualified land trusts, nonprofits and other eligible organizations can apply now for state conservation, recreation, trail and related grants. Administered by the Department of Conservation and Natural Resources, the Community Conservation Partnerships Program is funded with a variety of state and federal funding sources including Pennsylvania’s natural gas Impact Fee. Applications will be accepted through April 5. Online tutorials are available to aid organizations in the application process. Free Tax Help Available for Qualified IndividualsIn the Enews update I sent Jan. 13, I shared information about free tax help for qualified individuals offered by Volunteer Income Tax Assistance (VITA). A list of VITA’s locations can be found here. AARP also offers free tax assistance to qualified individuals earning $60,000 or less through its Foundation Tax-Aide Program. In-person appointments are being scheduled at 10 sites across Lancaster County. Please call 211 to schedule an appointment or click here to book it online. Lowering the Risk of Birth Defects

Rates of infant deaths due to birth defects have declined by 10% in the United States. However, even today, every 4½ minutes a baby is born with a major problem affecting parts of the body including the heart, brain or foot, causing lifelong health challenges. The National Birth Defects Prevention Network offers women five tips for preventing birth defects:

Not all birth defects can be prevented. However, healthy choices and habits help lower the risk of having a baby born with these challenges. |

||

|

||

Want to change how you receive these emails? 2024 © Senate of Pennsylvania | https://www.senatoraument.com | Privacy Policy |