|

||

|

Thank you for subscribing to my E-newsletter. I am honored to serve the 36th Senatorial District and look forward to working with you toward building a stronger Pennsylvania. This E-newsletter serves to keep you updated on what is happening throughout Lancaster County and what I am doing as your State Senator in Harrisburg – I hope that you find it helpful! Should you have any questions, comments, or concerns, please DO NOT reply to this email; instead, please feel free to contact me here.

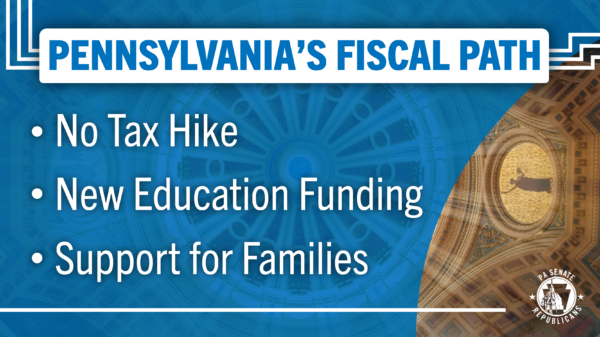

Senate Passes State Budget that Cuts Taxes, Funds Vital Programs, & Positions Pennsylvanians for Future Success

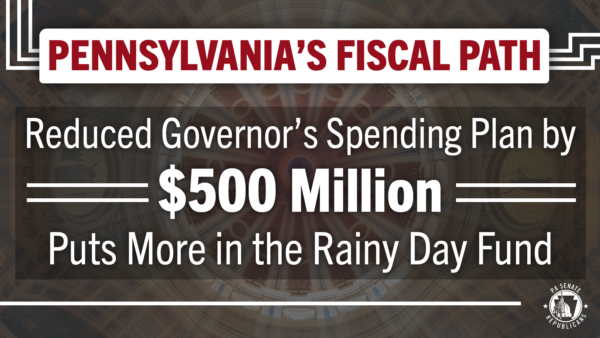

The Senate approved a $45.2 billion General Fund Budget for Fiscal Year 2022-23 that meets the needs of Pennsylvanians today while protecting taxpayers in the future. Senate Bill 1100 was sent to the governor for enactment. The $45.2 billion budget, which also includes federal American Rescue Plan Act (ARPA) funds, represents a 2.9% increase over the previous year’s spending – and $500 million less than Gov. Tom Wolf’s original budget request. Tax Cuts to Attract Employers and Residents

The budget agreement does not include any broad-based tax increases and is structured in a way to minimize the risk of tax increases in the years ahead. In fact, the budget actually includes a version of a proposal I introduced to cut the Corporate Net Income (CNI) tax rate from 9.99% to 8.99% and creates a phased reduction to 4.99% by 2031, moves designed to attract employers and residents to Pennsylvania. To better prepare Pennsylvania students to fill these job openings, the budget also included another proposal I sponsored that would establish a commission to redesign the state’s education system with the needs of these rising industries in mind. Positioning Pennsylvanians for growth, upward economic mobility and competitiveness through forward-thinking public policies has long been a priority of mine. Lowering our Corporate Net Income Tax will bring more high-quality jobs to our state, raise worker wages, elevate home values, and increase economic opportunity for Pennsylvanians in every class, sector, and corner of the Commonwealth. Likewise, redesigning our education system to align the skills taught in our schools with the future needs of our job market will enable Pennsylvania students to go on to enjoy fulfilling work, stable incomes and lifelong careers. Other changes also ensure out-of-state companies that do business in Pennsylvania pay the proper amount of taxes; modernize expense deductions for small businesses, allowing small business owners more flexibility and tax planning opportunities; and provide tax incentives for small businesses to grow and invest in Pennsylvania. Protecting Taxpayers in Future Years

As important as the economic boost provided by this plan, which will have a projected ending balance of $3.6 billion, the 2022-23 budget includes a $2.1 billion transfer to the Rainy Day Fund, bringing the total balance to nearly $5 billion. These fiscally responsible steps are critical because many economic indicators are showing a risk of a recession on the horizon. Most recently, Pennsylvania’s Independent Fiscal Office estimated a 60% chance of economic stagnation or a “growth recession” happening, and a 30% chance of a recession. Every year Senate Republicans fight to put Pennsylvanians first in our state budgets by ensuring the services they rely on can continue without adding to their economic troubles with a tax hike or onerous regulations. This year is no different – we’ve held the line and prevented tax increases; we’ve increased funding for programs to help our most vulnerable residents during this period of historic inflation; we’ve protected our state from potential future economic downturns by adding money to our Rainy Day fund; and we’ve invested in the future of our Commonwealth and its residents by rejecting inflationary policies and band-aid solutions that don’t target the root causes of the economic troubles facing Pennsylvanians. In short, this budget plan will give Pennsylvanians relief today and it will position them for success for generations to come. Supporting Education

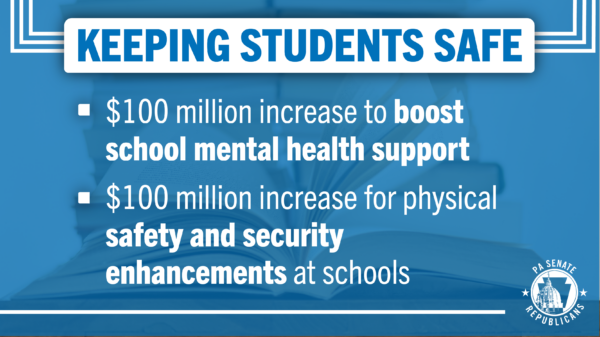

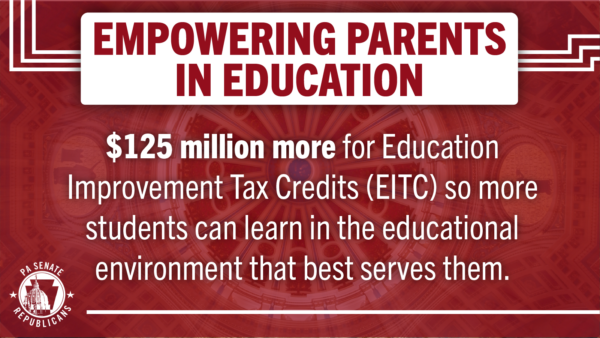

The budget includes a $525 million increase for Basic Education Funding, $225 million to provide additional support for the state’s 100 poorest school districts, a $100 million increase for Special Education funding, an additional $60 million for Pre-K Counts and $19 million more for Head Start Supplemental Assistance. It also includes an additional $125 million in Education Improvement Tax Credits to expand school choice for families and ensure more students can learn in the educational environment that best suits their needs. Higher education receives a funding boost as well. Increased funding is also dedicated in this year’s budget to ensure our schools are safe and secure: $100 million is appropriated for the Ready to Learn Block Grant program to address school-based mental health; and $100 million in funding is directed to a new General Fund appropriation for School Safety and Security to address physical safety and security at schools. School districts and communities must have the resources necessary to offer adequate mental health services to their students, especially during the aftermath of negative unintended consequences stemming from the COVID-19 shutdowns and school closures that have only worsened student instances of mental health crises around the country. In addition to the $100 million to address school-based mental health programs, an additional $100 million of ARPA funds will support mental health services in the broader community through programs administered by the Department of Human Services. Long-Term Care, Housing, Property Taxes, Child Care, and Fuel

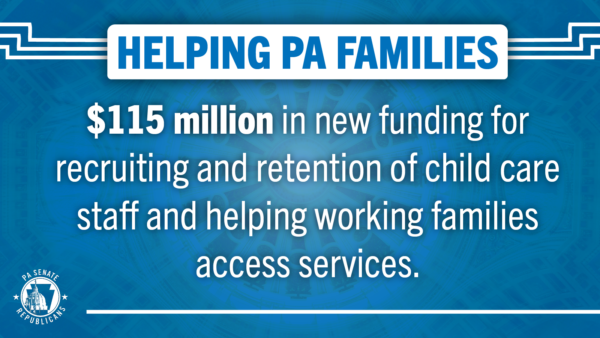

Building on our efforts last year to help address the serious financial challenges of our nursing homes and long-term care providers, this budget includes $150 million for costs related to nursing home staffing, $250 million in ARPA funding for long-term living programs and $20 million for supplementary payments to personal care homes. This budget also makes targeted investments in programs that will make a difference in the lives of millions of state residents, including programs to address the “child care cliff” when working individuals and families lose access to benefits due to increases in income. A total of $25 million will provide a sliding scale copayment for working individuals and families making between 235% and 300% of the federal poverty income limits. Another $90 million in ARPA funding will be used to pay for recruiting and retention bonuses for child care staff. With inflation driving up the cost of everything, including housing, both owned and rented, this budget directs $540 million in ARPA funding to help our most vulnerable and low-income residents by funding affordable housing construction programs, offering additional home repair assistance and bolstering the Low Income Home Energy Assistance Program and the Property Tax/Rent Rebate Program. Avian Influenza The spending plan makes critical investments to promote the health and stability of our food supply, including a $32 million funding increase to fight avian influenza, a priority of mine and other Lancaster County legislators concerned about an outbreak in the area earlier this year. Other Highlights of the New Budget

|

||

|

||

Want to change how you receive these emails? 2024 © Senate of Pennsylvania | https://www.senatoraument.com | Privacy Policy |