|

||

|

In this Update:

Senate Honors 15th Sergeant Major of the Army Daniel A. Dailey, (Retired)

It was an honor to join Senator John Yudichak (I-14) and Rep. Doyle Heffley (R-122) to honor my friend, the 15th Sergeant Major of the Army Daniel A. Dailey, US Army (Retired). SMA Dailey is a native of Palmerton, Pennsylvania and recently retired from the Army after 30 years of service to our country. During his career, Dailey held every enlisted position in the mechanized infantry, ranging from Bradley Fighting Vehicle commander to command sergeant major. In addition to four tours in support of Operation Iraqi Freedom and New Dawn, SMA Dailey deployed in support of Operation Desert Strom and Desert Shield. He earned the Bronze Star with Valor for his leadership during the 4th Infantry Division’s two-month battle for Sadr City in 2008. Watch my introduction of SMA Dailey and his inspirational speech on the Senate floor here. When it comes to Education: More Options, Less Arguments

I have consistently argued that local control is vital to addressing the unique needs and wants of our students. The issues facing Lancaster County schools will not be the same for schools in Allegheny or Tioga Counties. We have a diverse state with diverse challenges, and schools should always have the ability to hear the needs and wants of their students and families and make the best decisions to meet them. Though the majority of parents and students may currently be satisfied, no district plan or policy will fully meet the needs of every student despite the best and sincere efforts of our local school boards. And in the current debate about health and safety plans, as well as academic plans to make up the learning loss of the past year, parents deserve additional options when making decisions about the health, safety, and education of their children. To that end, I have proposed the establishment of a temporary education saving account program. Under our proposals, parents of school-aged children would be eligible for an education savings account if the school that was chosen for them by their zip code is not meeting their child’s education or health needs. Read my full joint op-ed with Representative Natalie Mihalek (R-40) here. Veterans: Please Join Me for an Appreciation BreakfastOn Monday, Nov. 22, from 8:30-10:30 a.m., I will be hosting a Veterans Appreciation Breakfast at Indian Rock Center, Woodcrest Retreat, 225 Woodcrest Drive, Ephrata. A complimentary breakfast from Shady Maple Smorgasboard will be provided, and George P. March of the Society of The Honor Guard will present a program in observance of the Centennial of the Tomb of the Unknown Soldier. Information about relevant legislation and veterans’ benefits will also be available. All veterans in the 36th District are invited to attend and may bring a spouse or guest. Seating is limited, so registration is required. Please call 717-627-0036 to RSVP or register online here. Promoting an Interest in Agriculture in the Next Generation

I recently joined Reps. Mindy Fee (R-37) and Dave Hickernell (R-98) to host a Farmers’ Breakfast. Young men and women from Manheim Central High School’s Future Farmers of America also participated. From left: students representing the Manheim Central High School FFA; Rep. Fee; Rep. Dan Moul, House Agriculture Committee chair; Rep. Hickernell; Rob Barley, PA Milk Marketing Board; me and Jon Slothour, PennAg Industries Association president. Honoring Achievement of Local Dancer

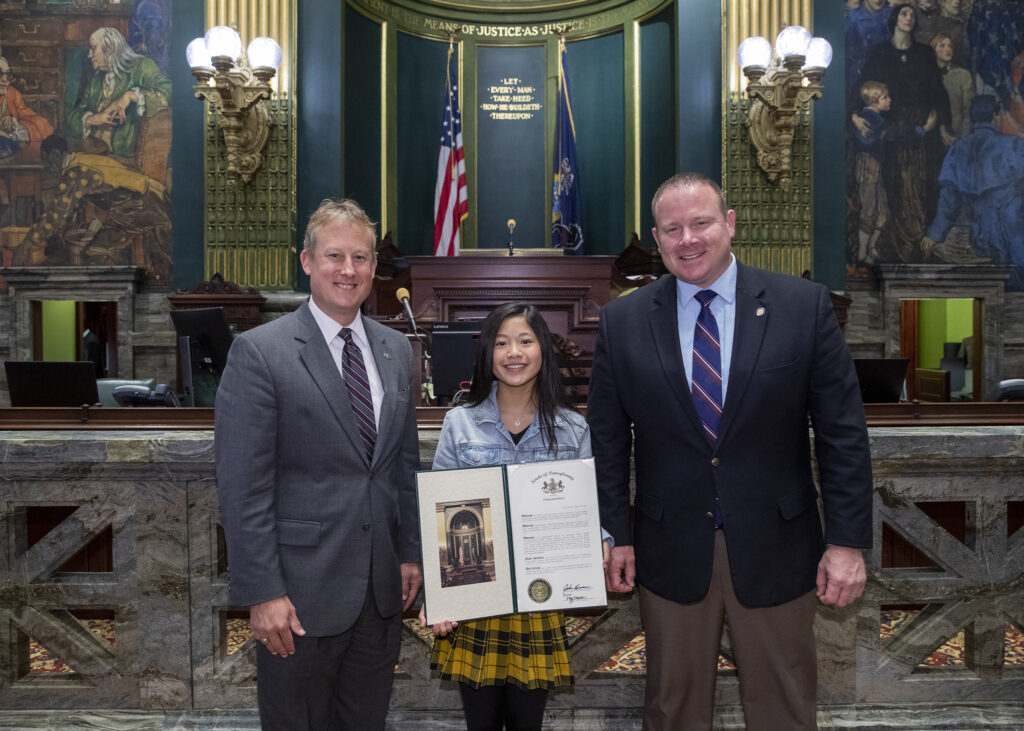

I had the pleasure of welcoming Natalie Raff and her family to the Capitol. My colleagues and I recognized her for capturing first place in the Girls’ 13-and-Under A Division of the 2021 United States National Irish Dance Championships. Natalie is an eighth-grade student at Conestoga Valley Middle School/Conestoga Valley Virtual Academy and studies at the Hooley School of Irish Dance. She qualified for the World Championships, which will be held in Belfast, Ireland in April 2022. Disapproving Pennsylvania Joining the Regional Greenhouse Gas Initiative

Seeking to assert the Pennsylvania General Assembly’s role regarding the Commonwealth entering into multi-state compacts and levying taxes, the state Senate voted to disapprove a regulation by the state Environmental Quality Board (EQB) to have Pennsylvania join the Regional Greenhouse Gas Initiative (RGGI). Gov. Tom Wolf three years ago said Pennsylvania was doing a great job reducing carbon dioxide (CO2) emissions, and that it wasn’t necessary to sign on “to something we’re already doing a better job on.” However, two years ago the governor flip-flopped and then circumvented the legislative process, unilaterally forcing Pennsylvania to join the current 11-member coalition of RGGI states. No other RGGI state has joined the coalition without the approval of that state’s legislature, and none of the other states comes close to having Pennsylvania’s number of electricity production facilities. The RGGI coalition operates what is called a CO2 “cap-and-trade” program, though the cost of the “emission allowances” traded within the program is, effectively, a tax on CO2 emissions by electricity producers. The concurrent resolution now goes to the state House of Representatives, which has a window of 10 legislative days or 30 calendar days to pass the resolution and present it to the governor. If Gov. Wolf vetoes the resolution, it will return to the Senate, which may consider overriding the veto. Two-thirds of the Senate must support the resolution to override the veto. Should the Senate override the veto, the measure would then go to the House where the same two-thirds vote is required. Even if a veto is not overridden, the process is probably far from complete, with an expectation this will end up in the courts, which will likely be asked to determine if imposing a CO2 tax is beyond the scope of the executive branch’s unilateral authority. Additionally, as this was initiated by executive order and not by state law approved by the General Assembly, Pennsylvania could very well be withdrawn from the RGGI by a future governor. Overcoming Barriers to Quality Health Care

The Senate approved legislation to promote telemedicine to overcome barriers to quality patient care created by distance and reduce the costs of those services. Telemedicine is a rapidly growing component of health care, and many health care professionals and hospitals in Pennsylvania are already providing services via telemedicine. However, currently none of the health care professionals’ licensure acts explicitly authorize or regulate practice via telemedicine. Senate Bill 705 defines “telemedicine” as “the delivery of health care services provided through telecommunications technology to a patient by a health care practitioner who is at a different location,” and allows anyone with a medical license or otherwise regulated by Pennsylvania law to provide telemedicine services. Through the use of telemedicine, specialists and other health care providers are able to expand their reach, helping COVID-19 patients, high-risk patients, stay-in-home patients, and rural patients who would have the ability to stay in their communities, avoiding long-distance travel for specialized care. The legislation now heads to the state House of Representatives for consideration. Senate Approves Bill to Boost Gifts to Charities

The Senate approved legislation that will make it easier for charities and nonprofit organizations to receive large financial gifts via Charitable Gift Annuities to fulfill their missions. The bill will be sent to the state House of Representatives for consideration. Charitable Gift Annuities provide donors the opportunity to support a charitable organization, while receiving fixed annuity payments. The payments can begin immediately, or the donor can choose to defer the payments to a future date. The terms of the arrangement are set forth in a contract signed by the nonprofit and the donor. The arrangement terminates on the death of the annuitant, at which point the nonprofit uses the remaining funds on its mission. Under current law, it is very difficult for smaller charitable organizations to utilize Charitable Gift Annuities, because the amount of unrestricted cash or publicly traded securities needed to cover the minimum is impractical and unworkable. A smaller foundation or charity must commit a significant amount of foundation resources to the annuity and not to its mission. Senate Bill 731 would allow charities to transfer their risk to a commercial insurance company, which will match substantially all future payments of the charity arising from a charitable gift annuity contract obligation. The change will allow a small nonprofit organization to receive a large charitable gift annuity that it previously may have been prevented from receiving. Heating Assistance Program Open Now

Residents who struggle with their home heating bills can now apply for assistance from the Low-Income Home Energy Assistance Program (LIHEAP). LIHEAP is a federally-funded program that helps individuals and families pay their heating bills through home heating energy assistance grants. It also provides crisis grants to help in the event of an emergency or if a resident is in danger of losing his or her heat due to broken equipment, lack of fuel or termination of utility service. The income limit for LIHEAP for an individual is $19,320; for a couple, the limit is $26,130; and for a family of four, it is $39,750. Residents may apply for LIHEAP online or by contacting the county assistance office in their county of residence. Click here for additional information. Working to Ban Deceptive “Spoofing” Phone Calls

In an effort to crack down on deceptive and nuisance telephone calls, the Senate approved a bill banning the practice of caller ID “spoofing.” Senate Bill 236 now heads to the state House of Representatives for its consideration. Senate Bill 236 is designed to protect citizens from misleading telemarketing “robocalls,” particularly those that disguise their real phone number by making it look like a local number, increasing the likelihood that the call will be answered. The computerized telemarketing messages can be intrusive and can also prey on trusting Pennsylvanians, including vulnerable senior citizens because the calls come across the caller ID as being a local number and are intended to confuse and defraud the recipients. The legislation also prevents telemarketing calls before 8 a.m. and after 8 p.m. Fish and Boat Commission is Accepting Boating Facility Grant Applications

The Pennsylvania Fish and Boat Commission (PFBC) is accepting applications from across the state for its Boating Facility Grant Program through Dec. 30 to help communities capitalize on the surge in new boating activity. The grant program provides funding to benefit public boating facilities located on the waters of the Commonwealth. It may be used for site acquisitions, development, expansion, preventions of the spread of aquatic invasive species and rehabilitation of recreational boat access facilities. Eligible construction projects include boat ramps, courtesy floats, restrooms, access roads, parking areas and signs. Funds may also be used to make facilities ADA compliant. Funding requests require a 50% match. PFBC encourages townships, boroughs and municipal and county governments to apply. Nonprofit groups (501c3) including land trusts, conservancies and watershed associations may also apply. Private businesses and service clubs are not eligible for direct funding but are encouraged to partner with their local county or municipality.

|

||

|

||

Want to change how you receive these emails? 2024 © Senate of Pennsylvania | https://www.senatoraument.com | Privacy Policy |